UAE Corporate Tax - Public Consultation Document

UAE Corporate Tax - Public Consultation Document

Download Aurifer’s reply to the Public Consultation initiated by the UAE Ministry of Finance in regard to the implementation of Corporate Income Tax in the UAE as of June 2023.

Scoring Tax Exemptions in Qatar

Scoring Tax Exemptions in Qatar

International sports bodies typically insist on obtaining widespread tax exemptions as a precondition to awarding the hosting rights to a bidder. This also applies for events organized by the Fédération Internationale de Football Association (FIFA). FIFA’s biggest event, the Football World Cup, will kick off later this month in Qatar.

Obtaining tax exemptions is such a sensitive topic for sports organizations that there have even been instances where the events have entirely moved to another country because a country was unable to grant the exemption. For example, the T20 Cricket World Cup was moved from India to the United Arab Emirates (UAE) and Oman last year because the Indian Government did not offer the exemptions in time.

In Qatar, even though Qatar has Free Zones, only the Qatar Financial Centre (QFC) issues its own tax framework. It applies next to the general tax framework applicable in the rest of the State of Qatar. We will be looking at these frameworks in this article.

Claiming Tax Exemptions (Substantive Aspects)

For mainland Qatar, Ministerial Decision No. 9 of 2022 (Ministerial Decision) issued earlier this year on 25 August 2022 = provides details on the exemptions available to different parties, based on Government Guarantee No. (3) dated 22 February 2010 (Government Guarantee) issued by the State of Qatar to FIFA.

The most comprehensive exemption benefits are provided to FIFA itself and its affiliates (whether residents or non-residents). They are totally exempt from any taxes.

Contractors are granted a limited exemption to the extent of all taxes on import, export or transfer of goods, services and rights related to the activities of the World Cup, if the goods are imported for their use by:

- The Contractors themselves in Qatar,

- The Contractors, with the possibility of re-exporting the goods,

- The Contractors, with the possibility to donate to sports entities, charitable foundations etc.

Individuals employed or appointed by the following, are also exempt from individual taxes on payments, fringe benefits or amounts paid or received in relation to the World Cup, until 31 December 2023:

- FIFA,

- FIFA’s affiliates,

- Continental or National Football Associations,

- Event broadcasters,

- Suppliers of goods,

- Works contractors and

- Service providers.

This exemption also covers Personal Income Taxes for those individuals who enter and exit Qatar between 60 days before the first match (21 September 2022) until 60 days after the final match (16 February 2023), as long as they do not permanently reside in Qatar. This exemption may be void of much effect, given the absence of Personal Income Tax in Qatar.

An Exemption from Excise tax is to be obtained by way of refund, by providing documents like purchase invoices and bank details.

Claiming The Exemptions - Logistical Aspects

For exemptions granted by the General Tax Authority (GTA), there is no requirement to register with the GTA. Instead, FIFA (through the Supreme Committee for Delivery and Legacy (Supreme Committee)) prepared a list of exempted entities and individual, containing data such as the nature of contracted works, term and value of the contract, and the residency of the contracting party.

The Supreme Committee then provides the GTA the relevant documentation (Articles of Associations of companies, addresses of individuals etc.) in regard to the organisation or individuals for whom the Tax Exemption is applied.

For claiming customs duty exemptions with the General Authority of Customs (GAC), (and unlike the procedure with the GTA), the claimants need to register with the GAC.

Here too, FIFA approves the list for the Supreme Committee to provide to the GAC to entitle those entities to exemptions from customs duties and fees. Based on this list, the GAC provides the listed entities amongst others with facilities in regard to electronic customs clearance.

In this regard, the GAC also earlier this year launched a ‘Sports Events Management System’ to facilitate customs procedures during sporting events, including the World Cup. This system provides electronic services for the clearance of goods, including easy registrations, accelerated customs procedures, and the inclusion of a special unit to facilitate approvals for incoming shipments.

There may be some interesting questions on the applicability of the Ministerial Decision, including:

- To what extent are the activities ‘directly or indirectly’ related to the activities of the World Cup? For example, does it include online betting platforms involved in placing bets on the matches? Would it include businesses that are involved in ancillary aspects to the World Cup such as general tourism consequent to the World Cup?

- Would match fee or advertisement / sponsorship / award income earned by the footballers in relation to the World Cup also be covered under the Ministerial Decision?

- Where an event broadcaster obtains substantial advertisement income from brand sponsors during the broadcast of the match or match related activities, is such income also exempt from taxes?

QFC - Tax Exemption Regime for the World Cup

The QFC in its Concessionary Statement of Practice (Statement) explicitly provides that a QFC entity which is a:

- FIFA subsidiary – is exempt from Corporation tax and any other charge, levy, penalty or interest related thereto;

- FIFA Host Broadcaster or a Local Organizing Committee (LoC) Entity – is exempt from Tax ‘in relation to taxable profits that are derived from activities carried on for the purposes of the World Cup’.

The major conditions for such QFC entities to claim the exemption are as follows:

- Such QFC entities have genuine economic substance in Qatar,

- The QFC entity operates in terms of the license and upon authorization of the Qatar Financial Centre Regulatory Authority (QFCRA),

- An Advanced Ruling has been applied for by the QFC entity and granted by the QFC, confirming the exempt status of such QFC entity,

- The QFC entity is included in the list provided by FIFA to the QFC Tax Department,

- The sole or main purpose of such QFC entity is not avoidance of tax,

- The QFC Tax Department is satisfied that granting the exemption is not in breach of international tax principles set out in the BEPS Project minimum standards.

The potential activities that can be developed in the QFC are limited, and therefore not all types of businesses can set up in the QFC.

No VAT – No VAT Exemption

Even though Qatar is a part of the GCC VAT Agreement and committed to implement VAT in the same vein as its neighboring countries of the UAE, Kingdom of Saudi Arabia (KSA), Bahrain and Oman have done, it has not yet enacted any legislation.

Therefore, there is currently no need for a VAT exemption for the World Cup. Who knows, VAT may be introduced shortly after the organization of the World Cup?

Exemptions Worth the Trouble?

Granting tax exemptions for international sporting events are sometimes controversial. The public in some hosting countries do not always believe they receive a return on investments from the event. While Qatar has spent substantial amounts of money on the construction of infrastructure, the effect of the tax exemptions is rather limited, and at least for Qatar, it seems to have been worth the investment. In any case, the exemptions are a precondition, without which a country cannot bid. After the UAE had hosted the FIFA Club World Cup a number of times, Saudi Arabia will now be looking at hosting the Asian Winter Games in 2029. Those countries have given similar tax concessions to the international organizations managing the events.

For future possible events in the UAE, it will also be interesting to see how the sporting organizations and the tax authorities will deal with the Corporate Income Tax (CIT) which is to be introduced in the UAE in June 2023. The relationship may be anything between an unbridled and full-fledged exemption (if the UAE is willing to do so), or it may lead to rather interesting tax claims (like the Formula 1 case on Permanent Establishment (PE) in India a few years ago, which was decided by the courts in the tax authority’s favor). Time alone can tell.

Almost 5 years down the line for VAT in the GCC – what’s next?

Almost 5 years down the line for VAT in the GCC – what’s next?

Almost 5 years down the line for VAT in the GCC – what’s next?

As we approach 31 December 2022, the UAE and KSA will be celebrating 5 years of applying VAT. A rollercoaster ride for many in the region, authorities, advisers and in house tax managers.

We wrote in 2017 about the challenges of drafting VAT legislation in the GCC before its implementation (https://aurifer.tax/news/the-challenges-of-drafting-tax-legislation-and-implementing-a-vat-in-the-gcc/?lid=482&p=21).

We pondered whether the GCC was potentially going to be far ahead of other jurisdictions because of the Electronic Services System (“ESS”) the GCC VAT Agreement was going to implement, foreseen in article 71 of the Agreement (https://aurifer.tax/news/future-of-vat-in-the-eu/?lid=482&p=22). The GCC however never implemented the ESS. It is therefore missing an important instrument to integrate all GCC members under a single comprehensive regional VAT framework.

After almost 5 years, it’s worth taking a step back and looking at what occurred.

6 countries to implement, only 4 did

The GCC consists of six countries, Saudi Arabia, the UAE, Bahrain, Oman, Kuwait and Qatar. All countries were supposed to introduce VAT in a short span of time. The UAE and KSA did so on 1 January 2018, Bahrain on 1 January 2019, and Oman on 16 April 2021. For Qatar, rumours ebb and flow on an implementation of VAT after the World Cup, but officials are tight lipped. In terms of Kuwait, a new government is not likely to put this on the table – at least, in the near future.

The intention to implement almost simultaneously was taken with the idea of avoiding arbitrage – considering the geographical proximity between the states - and potential issues with fraud.

5% was supposed to be the rate

All 4 countries kicked off with 5% VAT, as it is foreseen in the GCC VAT Agreement as well (article 25). Saudi Arabia was the first one to hike the rate to 15% on 1 July 2020. Bahrain increased to 10% on 1 January 2022.

The increases were implemented for the same reason, as the tax was implemented for in the first place, i.e. fiscal stability. The implementation came off the back of a protracted period of running deficits for many Gulf countries. There is currently a bounce back, but how long it will take is unclear, and therefore hard to predict whether it will impact fiscal policy in the short run.

Saudi Arabia, by way of its Finance Minister, had already stated in 2021 that it would consider revising the VAT rate downwards after the pandemic. If it will happen, it will happen soon.

It’s safe to say the other GCC countries could still revise the rate upwards or downwards, depending on their specific fiscal situation.

Interestingly, the increase of the VAT rate to 15% also spawned a new tax in KSA, the Real Estate Transfer Tax (“RETT”). This new tax in KSA aimed to solve the issue of unregistered sellers, and reduce the taxes on real estate sales. Since its introduction, the RETT legislation has been amended multiple times.

The GCC countries were supposed to have numerical VAT numbers, Oman didn’t follow

In the framework of the GCC, the idea was floated to have numbers as VAT numbers. Hence, the UAE has a 1 before the number, Bahrain a 2 and Saudi a 3. Oman however choose letters and put “OM” before the number.

In the EU, VAT numbers are also composed of letters and numbers. Two letters make up the first two symbols of the VAT number and refer to a country, e.g. “LU” refers to Luxembourg (see https://taxation-customs.ec.europa.eu/vat-identification-numbers_en).

Zero rates for services are perceived a complication

5 years in, the application to zero-rate VAT on exported services, i.e., services provided to recipients outside of the GCC, remains complicated for businesses to apply and inconsistent between the GCC member states.

Although the GCC VAT Agreement for place of supply purposes looks like the EU VAT directive, from the outset, each GCC member state chose different approaches towards the place of supply of services.

B2B services were not simply located in the country of the recipient, as they are in the EU since 2010, and as is recommended by the OECD in its VAT/GST Guidelines on B2B services.

Based on an interpretation of article 34(1)(c) of the GCC VAT Agreement as laying down the rule, and including a benefit test, GCC countries have embarked on a conservative and selective interpretation of the zero rate on supplies made from a GCC country to abroad.

That conservative interpretation is not necessarily mirrored when those services are received, as there is no benefit test required there.

The rule is therefore applied unequal, and as shown by both the UAE and KSA, they felt the rule required amendments to the provision itself (https://www.linkedin.com/pulse/uae-considerably-restricts-application-vat-zero-rate-services-vanhee/). Those amendments, and ensuing clarifications have not necessarily led to more clarity.

Unfortunately, Bahrain and Oman went down the same road. A too conservative view of zero rates, can put a strain on foreign investments, as it is not easy to obtain refunds for foreign businesses (as amongst others the Saudi example shows).

As a matter of fact, disputes are common among businesses in the GCC over the VAT treatment of cross-border services due to the difference in the domestic legislation between the GCC member states and in the absence of the ESS.

Divergent policy options

The GCC VAT Framework Agreement allowed for broad policy options in the education sector, health sector, real estate sector and local transport sector. In addition, for the oil & gas sector zero rates were allowed to be implemented as well, and the financial sector could benefit from a deviating regime as well. Depending on the individual requirements and policies, the GCC Member States have implemented substantially different regimes.

None of the GCC countries so far have amended those policies in the aforementioned sectors. The UAE did move from a system where the B2B sales of diamonds was taxed, to a system where it is subject to a reverse charge as from 1 June 2018.

Tax Authority approaches

So far, in the region ZATCA has shown the most grit in terms of audits, and has lengths ahead of the other countries in terms of tax audits and disputes. KSA also had the best equipped tax authority in 2018 when VAT was introduced, although it did have to go through an organizational revamp. The UAE comes second, which is remarkable for a tax authority which only kicked off in 2017. It has been very much a rules and process based organization, which has a lot of positive effects, such as tax payers feeling treated in the same way. UAE auditors now often also give the opportunity to tax payers to voluntarily disclose their liabilities before closing the audit, which is a novely approach in the region.

The Bahraini and Omani tax authority, have been taking a more relaxed approach towards audits and disputes.

Having said the above, it's all not all 'sticks' with the tax authorities. We have also observed in this 5 years, how the tax authorities, especially in KSA and the UAE, played a their role to alleviate tax from being a burden to businesses and encouraging tax compliance - a fairly new culture of this scale. The amnesty programmes, first introduced by the KSA in 2020 and again, recently paved the way on encouraging tax compliance for businesses. The UAE also introduced their amnesty programme this year with the same intention. Perhaps, this could be a temporary solution to gear the economy back on track post pandemic. On whether it will be the norm, is yet to be seen in the next coming years.

What the future will bring

An old-fashioned system was put in place, yet one that has proven its use in revenue collection. It also worked, given the substantial revenues gained from VAT.

The GCC did not opted to immediately adopt more modern, electronic systems as these exist elsewhere (e.g. since a long time in Brazil, but also China).

However, it was identified that E-invoicing was the way to go in the medium run. This is again trodding down a proven path. As often in the GCC, the UAE and KSA show the way. KSA has made E-invoicing mandatory. The UAE and Bahrain have already suggested they will do the same very soon.

No GCC countries have yet announced they will adopt real-time reporting. KSA may be the closest to a potential adoption, given that once phase 2 enters into force in 2023, ZATCA, the KSA tax authority will have access to substantial transactional data. It will allow it to pre-fill the VAT return, and potentially even in real time calculate the VAT.

We'll see what the future will bring, and for sure in another five years matters will have evolved again drastically, given the pace of changes in the region.

Safe to say that the next 5 years will be equally exciting.

How anti-avoidance provisions can curtail the application of Double Tax Treaties, including in the UAE?

The Ministry of Finance (MoF) of the United Arab Emirates (UAE) recently announced that the draft Corporate Tax (CT) law is going to be released soon, and likely within the month of September. This is impactful news for businesses in the UAE. Many businesses are already in the process of taking steps to plan their affairs in such a way that their operations are tax compliant and tax optimized at the same time.

The UAE’s international position will change after the implementation of corporate tax. Some jurisdictions may no longer view the UAE as a tax haven (although the Free Zone businesses may still benefit from a 0% rate). Other tax authorities may therefore change their perspective on the UAE and be more inclined to grant the benefits under the double tax treaties.

Businesses on the other hand, will no longer view the UAE as a conduit jurisdiction with an extensive treaty network, through which they can avail tax treaty benefits. While the 9% headline rate is still comparatively low, the implementation of CT may also discourage taxpayers seeking out the UAE solely for tax purposes.

A recurring point of dispute between the tax authority and businesses in almost every country having a CT regime has been drawing the line between tax planning, tax avoidance and tax evasion. Once the UAE CT regime settles, the Federal Tax Authority (FTA) of the UAE may indeed pay more attention towards countering tax avoidance and tax evasion arrangements or transactions.

In this article, we will revisit the evergreen discussion of tax planning, tax avoidance and tax evasion, with an emphasis on the Gulf Cooperation Council (GCC). To begin, let us examine the meaning of the terms tax avoidance and tax evasion and the differences between the two terms.

Tax avoidance has traditionally been considered as lawful. It can be described as planning for the purposes of minimizing the tax burden within the legal framework. Tax evasion on the other hand is considered unlawful, and often requires an intentional and a potential fraudulent element.

In the GCC, tax authorities resort rather quickly to suggesting a taxpayer has committed tax evasion, even when the situation concerns simple non-compliance.

While not considered unlawful, tax avoidance has been considered harmful. This is why countries around the world, including the GCC Member States, are implementing domestic rules to counter aggressive or harmful tax planning in line with international standards.

The OECD tried to address this point by way of the ‘Main Purpose Test’ (MPT). The MPT was included in the OECD’s Model Tax Convention in its 2003 version. We are paraphrasing, but the principle stated that benefits under a double tax treaty should not be granted where the main purpose of setting up a structure was for tax purposes as the tax benefits resulting from that structure would go counter the object and purpose of those treaties.

Another common mechanism proposed in tax treaties to avoid the improper use of tax treaties, is the ‘Beneficial Ownership’ (BO) requirement. It mainly applies to passive income (e.g., dividends, interests, and royalties). The BO concept provides that where an item of income is paid to a resident of a Contracting State acting in the capacity of an agent or a nominee, it would be inconsistent with the object and purpose of the source state to grant an exemption or relief, merely because the direct recipient is a resident of the other Contracting State. In such a case, the direct recipient, on account of being merely an agent, nominee, conduit, fiduciary, or administrator, would not be able to obtain the benefits of the treaty. This is especially evident if such recipient is legally or contractually bound to pass on the payment received to another person. BO disputes often end up before the courts, because the burden of proof for the taxpayer is not easily met.

The 2008 Financial Crisis put the discussion on tax avoidance and aggressive tax planning firmly on governments’ agenda. Following the Financial Crisis, public opinion shifted towards ensuring that big corporations pay their fair share of taxes and pressured countries to implement rules to discourage such behaviors.

As a result, the OECD established what is known as the ‘Inclusive Framework’ (IF), which was open to both OECD and non-OECD members (currently at 141 members) to engage in discussions and create rules for countering Base Erosion and Profit Shifting (BEPS). It is formally known as the OECD/G20 BEPS Project (BEPS Project 1.0) which identified 15 Action Points in 2015.

Out of the 15 Action Points, one of the most important action plans was BEPS Action 6 - Prevention of Tax Treaty Abuse, which also formed one of the four minimum standards. BEPS Action 6 addresses treaty shopping activities that would be viewed as avoidance.

BEPS Action 6 requires IF members, amongst others, to include an express statement in their treaties that their common intention is to eliminate double taxation without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance, including through treaty shopping arrangements.

Anti-avoidance rules aim amongst others to avoid conduit arrangements. For example, State A has a domestic withholding tax rate for dividends of 25%. State A and State B have negotiated a tax treaty where the source withholding tax rate for dividends is reduced to 5%. A resident in State B receives dividends from State A and claims the reduced treaty rate of 5% source withholding.

However, the resident in State B has an obligation to redistribute the dividend income to a resident in State C. State A and State C do not have a tax treaty in place. It can be observed that there is no BO in State B due to its obligation to pass the payment onto another party. Clearly, such payment is not made for the benefit of any resident in State B nor for enhancing economic cooperation between States A and B. Instead, the benefit would be received by the resident of a third State (i.e., State C). This clearly shows that the treaty has been misused or abused by the resident of State B, against the intention, object, and purpose of the treaty between States A and B.

To combat misuse of the treaty like the case described above, BEPS Action 6 seeks IF members to implement a ‘minimum standard’ in all its treaties. The minimum standard can be either of the following:

- The combined approach of a Limitation of Benefits (LOB) and a Principal Purpose Test (PPT) rule,

- The PPT rule alone, or

- The LOB rule supplemented by a mechanism that would deal with conduit financing arrangements not already dealt with in tax treaties.

As a consequence, many IF members’ tax treaties have been updated to include, at least, a PPT rule. This is done by way of signing and ratifying the Multilateral Instrument (MLI) as it allows IF members to update multiple bilateral tax treaties simultaneously. The PPT rule looks a lot like the MPT. True to its name, if one of the principal purposes of an arrangement is to obtain a benefit, the PPT rule may be triggered. This clear intention has also been expressed in the wordings of the preamble incorporated in the OECD Model Tax Convention 2017.

Due to the lack of case law, the impact of the PPT rule is rather uncertain for now and the interpretation of the PPT rule may vary across jurisdictions. It may be possible that the cases that were successfully tested before the courts of law earlier may not survive the PPT rule if they were to be presented before the courts today, provided that the PPT rule was applicable at the time of the transaction or arrangement.

What is certain is that taxpayers ought to be very careful in tax planning so that the structures do not fall foul of the PPT rule. When deciding on the country to make an investment in or the structure of a transaction or arrangement, taxpayers ought to clearly record the non-tax reasons (main/principal purposes) for selecting a certain jurisdiction over another. Evidence can be maintained through internal emails, memos, and minutes outlining the reasons for selecting a country. For example:

- A country is preferred due to a favourable corporate law regime.

- A country is preferred due to the presence of multilingual or highly qualified employees.

- A country is preferred as it is politically and socially stable.

- A country is preferred as it has a strong banking infrastructure where it is easy to obtain credit.

Despite the above safeguards, if the tax authority does reasonably conclude that one of the principal purposes of invoking the treaty was to obtain a tax benefit, the taxpayer ought to ensure that it can establish (i.e., prove) that the benefit obtained was indeed within the object and purpose of the tax treaty.

Finally, as mentioned before, public opinion against tax avoidance is stronger than ever. The relevance of the PPT to future transactions cannot be overstated. Arrangements that may have been successfully litigated before the courts of law until a few years ago, may not be as successful from now on. Therefore, taxpayers may find advance rulings to be attractive as it is important to avoid future issues.

It will be interesting to see how the UAE and the other GCC countries will approach such abusive arrangements and its possible disputes. In the meantime, it is apparent that either through the MLI or through bilateral double tax treaties, the PPT continues to be important. It is vital to consider such anti-avoidance provisions now in order to create future proof structures.

UAE Corporate Tax - Public Consultation Document

UAE Corporate Tax - Public Consultation Document

Download Aurifer’s reply to the Public Consultation initiated by the UAE Ministry of Finance in regard to the implementation of Corporate Income Tax in the UAE as of June 2023.

Scoring Tax Exemptions in Qatar

Scoring Tax Exemptions in Qatar

International sports bodies typically insist on obtaining widespread tax exemptions as a precondition to awarding the hosting rights to a bidder. This also applies for events organized by the Fédération Internationale de Football Association (FIFA). FIFA’s biggest event, the Football World Cup, will kick off later this month in Qatar.

Obtaining tax exemptions is such a sensitive topic for sports organizations that there have even been instances where the events have entirely moved to another country because a country was unable to grant the exemption. For example, the T20 Cricket World Cup was moved from India to the United Arab Emirates (UAE) and Oman last year because the Indian Government did not offer the exemptions in time.

In Qatar, even though Qatar has Free Zones, only the Qatar Financial Centre (QFC) issues its own tax framework. It applies next to the general tax framework applicable in the rest of the State of Qatar. We will be looking at these frameworks in this article.

Claiming Tax Exemptions (Substantive Aspects)

For mainland Qatar, Ministerial Decision No. 9 of 2022 (Ministerial Decision) issued earlier this year on 25 August 2022 = provides details on the exemptions available to different parties, based on Government Guarantee No. (3) dated 22 February 2010 (Government Guarantee) issued by the State of Qatar to FIFA.

The most comprehensive exemption benefits are provided to FIFA itself and its affiliates (whether residents or non-residents). They are totally exempt from any taxes.

Contractors are granted a limited exemption to the extent of all taxes on import, export or transfer of goods, services and rights related to the activities of the World Cup, if the goods are imported for their use by:

- The Contractors themselves in Qatar,

- The Contractors, with the possibility of re-exporting the goods,

- The Contractors, with the possibility to donate to sports entities, charitable foundations etc.

Individuals employed or appointed by the following, are also exempt from individual taxes on payments, fringe benefits or amounts paid or received in relation to the World Cup, until 31 December 2023:

- FIFA,

- FIFA’s affiliates,

- Continental or National Football Associations,

- Event broadcasters,

- Suppliers of goods,

- Works contractors and

- Service providers.

This exemption also covers Personal Income Taxes for those individuals who enter and exit Qatar between 60 days before the first match (21 September 2022) until 60 days after the final match (16 February 2023), as long as they do not permanently reside in Qatar. This exemption may be void of much effect, given the absence of Personal Income Tax in Qatar.

An Exemption from Excise tax is to be obtained by way of refund, by providing documents like purchase invoices and bank details.

Claiming The Exemptions - Logistical Aspects

For exemptions granted by the General Tax Authority (GTA), there is no requirement to register with the GTA. Instead, FIFA (through the Supreme Committee for Delivery and Legacy (Supreme Committee)) prepared a list of exempted entities and individual, containing data such as the nature of contracted works, term and value of the contract, and the residency of the contracting party.

The Supreme Committee then provides the GTA the relevant documentation (Articles of Associations of companies, addresses of individuals etc.) in regard to the organisation or individuals for whom the Tax Exemption is applied.

For claiming customs duty exemptions with the General Authority of Customs (GAC), (and unlike the procedure with the GTA), the claimants need to register with the GAC.

Here too, FIFA approves the list for the Supreme Committee to provide to the GAC to entitle those entities to exemptions from customs duties and fees. Based on this list, the GAC provides the listed entities amongst others with facilities in regard to electronic customs clearance.

In this regard, the GAC also earlier this year launched a ‘Sports Events Management System’ to facilitate customs procedures during sporting events, including the World Cup. This system provides electronic services for the clearance of goods, including easy registrations, accelerated customs procedures, and the inclusion of a special unit to facilitate approvals for incoming shipments.

There may be some interesting questions on the applicability of the Ministerial Decision, including:

- To what extent are the activities ‘directly or indirectly’ related to the activities of the World Cup? For example, does it include online betting platforms involved in placing bets on the matches? Would it include businesses that are involved in ancillary aspects to the World Cup such as general tourism consequent to the World Cup?

- Would match fee or advertisement / sponsorship / award income earned by the footballers in relation to the World Cup also be covered under the Ministerial Decision?

- Where an event broadcaster obtains substantial advertisement income from brand sponsors during the broadcast of the match or match related activities, is such income also exempt from taxes?

QFC - Tax Exemption Regime for the World Cup

The QFC in its Concessionary Statement of Practice (Statement) explicitly provides that a QFC entity which is a:

- FIFA subsidiary – is exempt from Corporation tax and any other charge, levy, penalty or interest related thereto;

- FIFA Host Broadcaster or a Local Organizing Committee (LoC) Entity – is exempt from Tax ‘in relation to taxable profits that are derived from activities carried on for the purposes of the World Cup’.

The major conditions for such QFC entities to claim the exemption are as follows:

- Such QFC entities have genuine economic substance in Qatar,

- The QFC entity operates in terms of the license and upon authorization of the Qatar Financial Centre Regulatory Authority (QFCRA),

- An Advanced Ruling has been applied for by the QFC entity and granted by the QFC, confirming the exempt status of such QFC entity,

- The QFC entity is included in the list provided by FIFA to the QFC Tax Department,

- The sole or main purpose of such QFC entity is not avoidance of tax,

- The QFC Tax Department is satisfied that granting the exemption is not in breach of international tax principles set out in the BEPS Project minimum standards.

The potential activities that can be developed in the QFC are limited, and therefore not all types of businesses can set up in the QFC.

No VAT – No VAT Exemption

Even though Qatar is a part of the GCC VAT Agreement and committed to implement VAT in the same vein as its neighboring countries of the UAE, Kingdom of Saudi Arabia (KSA), Bahrain and Oman have done, it has not yet enacted any legislation.

Therefore, there is currently no need for a VAT exemption for the World Cup. Who knows, VAT may be introduced shortly after the organization of the World Cup?

Exemptions Worth the Trouble?

Granting tax exemptions for international sporting events are sometimes controversial. The public in some hosting countries do not always believe they receive a return on investments from the event. While Qatar has spent substantial amounts of money on the construction of infrastructure, the effect of the tax exemptions is rather limited, and at least for Qatar, it seems to have been worth the investment. In any case, the exemptions are a precondition, without which a country cannot bid. After the UAE had hosted the FIFA Club World Cup a number of times, Saudi Arabia will now be looking at hosting the Asian Winter Games in 2029. Those countries have given similar tax concessions to the international organizations managing the events.

For future possible events in the UAE, it will also be interesting to see how the sporting organizations and the tax authorities will deal with the Corporate Income Tax (CIT) which is to be introduced in the UAE in June 2023. The relationship may be anything between an unbridled and full-fledged exemption (if the UAE is willing to do so), or it may lead to rather interesting tax claims (like the Formula 1 case on Permanent Establishment (PE) in India a few years ago, which was decided by the courts in the tax authority’s favor). Time alone can tell.

Almost 5 years down the line for VAT in the GCC – what’s next?

Almost 5 years down the line for VAT in the GCC – what’s next?

Almost 5 years down the line for VAT in the GCC – what’s next?

As we approach 31 December 2022, the UAE and KSA will be celebrating 5 years of applying VAT. A rollercoaster ride for many in the region, authorities, advisers and in house tax managers.

We wrote in 2017 about the challenges of drafting VAT legislation in the GCC before its implementation (https://aurifer.tax/news/the-challenges-of-drafting-tax-legislation-and-implementing-a-vat-in-the-gcc/?lid=482&p=21).

We pondered whether the GCC was potentially going to be far ahead of other jurisdictions because of the Electronic Services System (“ESS”) the GCC VAT Agreement was going to implement, foreseen in article 71 of the Agreement (https://aurifer.tax/news/future-of-vat-in-the-eu/?lid=482&p=22). The GCC however never implemented the ESS. It is therefore missing an important instrument to integrate all GCC members under a single comprehensive regional VAT framework.

After almost 5 years, it’s worth taking a step back and looking at what occurred.

6 countries to implement, only 4 did

The GCC consists of six countries, Saudi Arabia, the UAE, Bahrain, Oman, Kuwait and Qatar. All countries were supposed to introduce VAT in a short span of time. The UAE and KSA did so on 1 January 2018, Bahrain on 1 January 2019, and Oman on 16 April 2021. For Qatar, rumours ebb and flow on an implementation of VAT after the World Cup, but officials are tight lipped. In terms of Kuwait, a new government is not likely to put this on the table – at least, in the near future.

The intention to implement almost simultaneously was taken with the idea of avoiding arbitrage – considering the geographical proximity between the states - and potential issues with fraud.

5% was supposed to be the rate

All 4 countries kicked off with 5% VAT, as it is foreseen in the GCC VAT Agreement as well (article 25). Saudi Arabia was the first one to hike the rate to 15% on 1 July 2020. Bahrain increased to 10% on 1 January 2022.

The increases were implemented for the same reason, as the tax was implemented for in the first place, i.e. fiscal stability. The implementation came off the back of a protracted period of running deficits for many Gulf countries. There is currently a bounce back, but how long it will take is unclear, and therefore hard to predict whether it will impact fiscal policy in the short run.

Saudi Arabia, by way of its Finance Minister, had already stated in 2021 that it would consider revising the VAT rate downwards after the pandemic. If it will happen, it will happen soon.

It’s safe to say the other GCC countries could still revise the rate upwards or downwards, depending on their specific fiscal situation.

Interestingly, the increase of the VAT rate to 15% also spawned a new tax in KSA, the Real Estate Transfer Tax (“RETT”). This new tax in KSA aimed to solve the issue of unregistered sellers, and reduce the taxes on real estate sales. Since its introduction, the RETT legislation has been amended multiple times.

The GCC countries were supposed to have numerical VAT numbers, Oman didn’t follow

In the framework of the GCC, the idea was floated to have numbers as VAT numbers. Hence, the UAE has a 1 before the number, Bahrain a 2 and Saudi a 3. Oman however choose letters and put “OM” before the number.

In the EU, VAT numbers are also composed of letters and numbers. Two letters make up the first two symbols of the VAT number and refer to a country, e.g. “LU” refers to Luxembourg (see https://taxation-customs.ec.europa.eu/vat-identification-numbers_en).

Zero rates for services are perceived a complication

5 years in, the application to zero-rate VAT on exported services, i.e., services provided to recipients outside of the GCC, remains complicated for businesses to apply and inconsistent between the GCC member states.

Although the GCC VAT Agreement for place of supply purposes looks like the EU VAT directive, from the outset, each GCC member state chose different approaches towards the place of supply of services.

B2B services were not simply located in the country of the recipient, as they are in the EU since 2010, and as is recommended by the OECD in its VAT/GST Guidelines on B2B services.

Based on an interpretation of article 34(1)(c) of the GCC VAT Agreement as laying down the rule, and including a benefit test, GCC countries have embarked on a conservative and selective interpretation of the zero rate on supplies made from a GCC country to abroad.

That conservative interpretation is not necessarily mirrored when those services are received, as there is no benefit test required there.

The rule is therefore applied unequal, and as shown by both the UAE and KSA, they felt the rule required amendments to the provision itself (https://www.linkedin.com/pulse/uae-considerably-restricts-application-vat-zero-rate-services-vanhee/). Those amendments, and ensuing clarifications have not necessarily led to more clarity.

Unfortunately, Bahrain and Oman went down the same road. A too conservative view of zero rates, can put a strain on foreign investments, as it is not easy to obtain refunds for foreign businesses (as amongst others the Saudi example shows).

As a matter of fact, disputes are common among businesses in the GCC over the VAT treatment of cross-border services due to the difference in the domestic legislation between the GCC member states and in the absence of the ESS.

Divergent policy options

The GCC VAT Framework Agreement allowed for broad policy options in the education sector, health sector, real estate sector and local transport sector. In addition, for the oil & gas sector zero rates were allowed to be implemented as well, and the financial sector could benefit from a deviating regime as well. Depending on the individual requirements and policies, the GCC Member States have implemented substantially different regimes.

None of the GCC countries so far have amended those policies in the aforementioned sectors. The UAE did move from a system where the B2B sales of diamonds was taxed, to a system where it is subject to a reverse charge as from 1 June 2018.

Tax Authority approaches

So far, in the region ZATCA has shown the most grit in terms of audits, and has lengths ahead of the other countries in terms of tax audits and disputes. KSA also had the best equipped tax authority in 2018 when VAT was introduced, although it did have to go through an organizational revamp. The UAE comes second, which is remarkable for a tax authority which only kicked off in 2017. It has been very much a rules and process based organization, which has a lot of positive effects, such as tax payers feeling treated in the same way. UAE auditors now often also give the opportunity to tax payers to voluntarily disclose their liabilities before closing the audit, which is a novely approach in the region.

The Bahraini and Omani tax authority, have been taking a more relaxed approach towards audits and disputes.

Having said the above, it's all not all 'sticks' with the tax authorities. We have also observed in this 5 years, how the tax authorities, especially in KSA and the UAE, played a their role to alleviate tax from being a burden to businesses and encouraging tax compliance - a fairly new culture of this scale. The amnesty programmes, first introduced by the KSA in 2020 and again, recently paved the way on encouraging tax compliance for businesses. The UAE also introduced their amnesty programme this year with the same intention. Perhaps, this could be a temporary solution to gear the economy back on track post pandemic. On whether it will be the norm, is yet to be seen in the next coming years.

What the future will bring

An old-fashioned system was put in place, yet one that has proven its use in revenue collection. It also worked, given the substantial revenues gained from VAT.

The GCC did not opted to immediately adopt more modern, electronic systems as these exist elsewhere (e.g. since a long time in Brazil, but also China).

However, it was identified that E-invoicing was the way to go in the medium run. This is again trodding down a proven path. As often in the GCC, the UAE and KSA show the way. KSA has made E-invoicing mandatory. The UAE and Bahrain have already suggested they will do the same very soon.

No GCC countries have yet announced they will adopt real-time reporting. KSA may be the closest to a potential adoption, given that once phase 2 enters into force in 2023, ZATCA, the KSA tax authority will have access to substantial transactional data. It will allow it to pre-fill the VAT return, and potentially even in real time calculate the VAT.

We'll see what the future will bring, and for sure in another five years matters will have evolved again drastically, given the pace of changes in the region.

Safe to say that the next 5 years will be equally exciting.

How anti-avoidance provisions can curtail the application of Double Tax Treaties, including in the UAE?

The Ministry of Finance (MoF) of the United Arab Emirates (UAE) recently announced that the draft Corporate Tax (CT) law is going to be released soon, and likely within the month of September. This is impactful news for businesses in the UAE. Many businesses are already in the process of taking steps to plan their affairs in such a way that their operations are tax compliant and tax optimized at the same time.

The UAE’s international position will change after the implementation of corporate tax. Some jurisdictions may no longer view the UAE as a tax haven (although the Free Zone businesses may still benefit from a 0% rate). Other tax authorities may therefore change their perspective on the UAE and be more inclined to grant the benefits under the double tax treaties.

Businesses on the other hand, will no longer view the UAE as a conduit jurisdiction with an extensive treaty network, through which they can avail tax treaty benefits. While the 9% headline rate is still comparatively low, the implementation of CT may also discourage taxpayers seeking out the UAE solely for tax purposes.

A recurring point of dispute between the tax authority and businesses in almost every country having a CT regime has been drawing the line between tax planning, tax avoidance and tax evasion. Once the UAE CT regime settles, the Federal Tax Authority (FTA) of the UAE may indeed pay more attention towards countering tax avoidance and tax evasion arrangements or transactions.

In this article, we will revisit the evergreen discussion of tax planning, tax avoidance and tax evasion, with an emphasis on the Gulf Cooperation Council (GCC). To begin, let us examine the meaning of the terms tax avoidance and tax evasion and the differences between the two terms.

Tax avoidance has traditionally been considered as lawful. It can be described as planning for the purposes of minimizing the tax burden within the legal framework. Tax evasion on the other hand is considered unlawful, and often requires an intentional and a potential fraudulent element.

In the GCC, tax authorities resort rather quickly to suggesting a taxpayer has committed tax evasion, even when the situation concerns simple non-compliance.

While not considered unlawful, tax avoidance has been considered harmful. This is why countries around the world, including the GCC Member States, are implementing domestic rules to counter aggressive or harmful tax planning in line with international standards.

The OECD tried to address this point by way of the ‘Main Purpose Test’ (MPT). The MPT was included in the OECD’s Model Tax Convention in its 2003 version. We are paraphrasing, but the principle stated that benefits under a double tax treaty should not be granted where the main purpose of setting up a structure was for tax purposes as the tax benefits resulting from that structure would go counter the object and purpose of those treaties.

Another common mechanism proposed in tax treaties to avoid the improper use of tax treaties, is the ‘Beneficial Ownership’ (BO) requirement. It mainly applies to passive income (e.g., dividends, interests, and royalties). The BO concept provides that where an item of income is paid to a resident of a Contracting State acting in the capacity of an agent or a nominee, it would be inconsistent with the object and purpose of the source state to grant an exemption or relief, merely because the direct recipient is a resident of the other Contracting State. In such a case, the direct recipient, on account of being merely an agent, nominee, conduit, fiduciary, or administrator, would not be able to obtain the benefits of the treaty. This is especially evident if such recipient is legally or contractually bound to pass on the payment received to another person. BO disputes often end up before the courts, because the burden of proof for the taxpayer is not easily met.

The 2008 Financial Crisis put the discussion on tax avoidance and aggressive tax planning firmly on governments’ agenda. Following the Financial Crisis, public opinion shifted towards ensuring that big corporations pay their fair share of taxes and pressured countries to implement rules to discourage such behaviors.

As a result, the OECD established what is known as the ‘Inclusive Framework’ (IF), which was open to both OECD and non-OECD members (currently at 141 members) to engage in discussions and create rules for countering Base Erosion and Profit Shifting (BEPS). It is formally known as the OECD/G20 BEPS Project (BEPS Project 1.0) which identified 15 Action Points in 2015.

Out of the 15 Action Points, one of the most important action plans was BEPS Action 6 - Prevention of Tax Treaty Abuse, which also formed one of the four minimum standards. BEPS Action 6 addresses treaty shopping activities that would be viewed as avoidance.

BEPS Action 6 requires IF members, amongst others, to include an express statement in their treaties that their common intention is to eliminate double taxation without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance, including through treaty shopping arrangements.

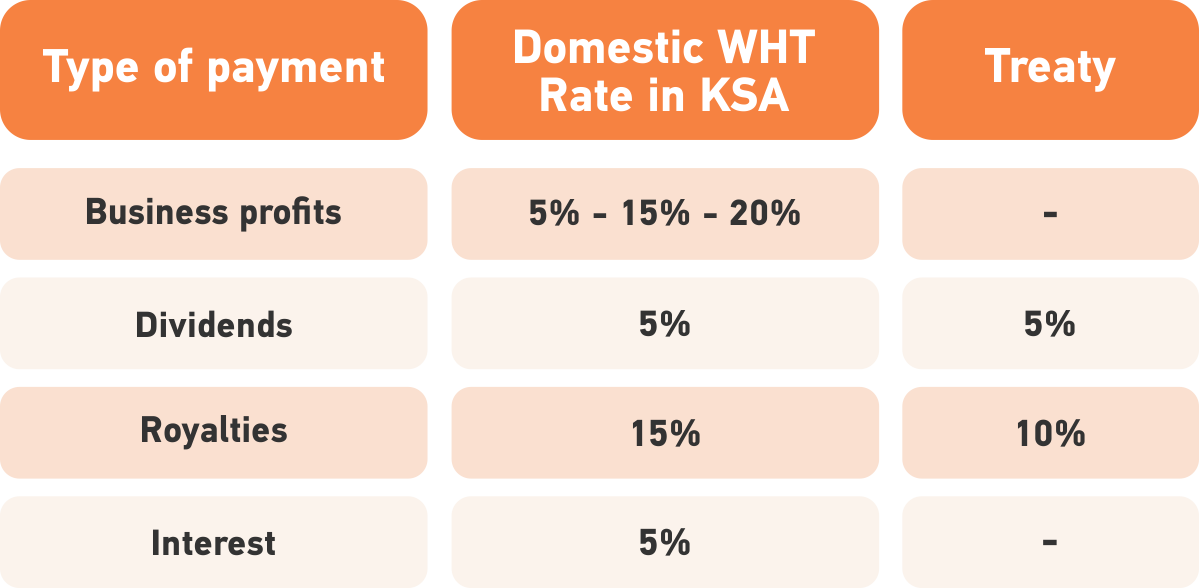

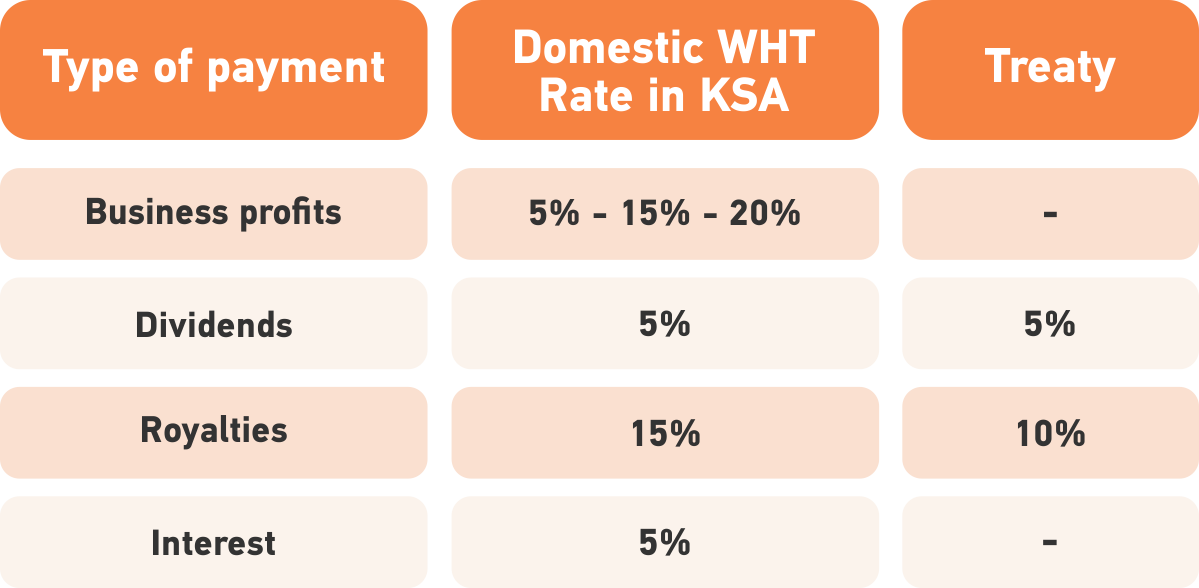

Anti-avoidance rules aim amongst others to avoid conduit arrangements. For example, State A has a domestic withholding tax rate for dividends of 25%. State A and State B have negotiated a tax treaty where the source withholding tax rate for dividends is reduced to 5%. A resident in State B receives dividends from State A and claims the reduced treaty rate of 5% source withholding.

However, the resident in State B has an obligation to redistribute the dividend income to a resident in State C. State A and State C do not have a tax treaty in place. It can be observed that there is no BO in State B due to its obligation to pass the payment onto another party. Clearly, such payment is not made for the benefit of any resident in State B nor for enhancing economic cooperation between States A and B. Instead, the benefit would be received by the resident of a third State (i.e., State C). This clearly shows that the treaty has been misused or abused by the resident of State B, against the intention, object, and purpose of the treaty between States A and B.

To combat misuse of the treaty like the case described above, BEPS Action 6 seeks IF members to implement a ‘minimum standard’ in all its treaties. The minimum standard can be either of the following:

- The combined approach of a Limitation of Benefits (LOB) and a Principal Purpose Test (PPT) rule,

- The PPT rule alone, or

- The LOB rule supplemented by a mechanism that would deal with conduit financing arrangements not already dealt with in tax treaties.

As a consequence, many IF members’ tax treaties have been updated to include, at least, a PPT rule. This is done by way of signing and ratifying the Multilateral Instrument (MLI) as it allows IF members to update multiple bilateral tax treaties simultaneously. The PPT rule looks a lot like the MPT. True to its name, if one of the principal purposes of an arrangement is to obtain a benefit, the PPT rule may be triggered. This clear intention has also been expressed in the wordings of the preamble incorporated in the OECD Model Tax Convention 2017.

Due to the lack of case law, the impact of the PPT rule is rather uncertain for now and the interpretation of the PPT rule may vary across jurisdictions. It may be possible that the cases that were successfully tested before the courts of law earlier may not survive the PPT rule if they were to be presented before the courts today, provided that the PPT rule was applicable at the time of the transaction or arrangement.

What is certain is that taxpayers ought to be very careful in tax planning so that the structures do not fall foul of the PPT rule. When deciding on the country to make an investment in or the structure of a transaction or arrangement, taxpayers ought to clearly record the non-tax reasons (main/principal purposes) for selecting a certain jurisdiction over another. Evidence can be maintained through internal emails, memos, and minutes outlining the reasons for selecting a country. For example:

- A country is preferred due to a favourable corporate law regime.

- A country is preferred due to the presence of multilingual or highly qualified employees.

- A country is preferred as it is politically and socially stable.

- A country is preferred as it has a strong banking infrastructure where it is easy to obtain credit.

Despite the above safeguards, if the tax authority does reasonably conclude that one of the principal purposes of invoking the treaty was to obtain a tax benefit, the taxpayer ought to ensure that it can establish (i.e., prove) that the benefit obtained was indeed within the object and purpose of the tax treaty.

Finally, as mentioned before, public opinion against tax avoidance is stronger than ever. The relevance of the PPT to future transactions cannot be overstated. Arrangements that may have been successfully litigated before the courts of law until a few years ago, may not be as successful from now on. Therefore, taxpayers may find advance rulings to be attractive as it is important to avoid future issues.

It will be interesting to see how the UAE and the other GCC countries will approach such abusive arrangements and its possible disputes. In the meantime, it is apparent that either through the MLI or through bilateral double tax treaties, the PPT continues to be important. It is vital to consider such anti-avoidance provisions now in order to create future proof structures.

UAE Corporate Tax - Public Consultation Document

UAE Corporate Tax - Public Consultation Document

Download Aurifer’s reply to the Public Consultation initiated by the UAE Ministry of Finance in regard to the implementation of Corporate Income Tax in the UAE as of June 2023.

Scoring Tax Exemptions in Qatar

Scoring Tax Exemptions in Qatar

International sports bodies typically insist on obtaining widespread tax exemptions as a precondition to awarding the hosting rights to a bidder. This also applies for events organized by the Fédération Internationale de Football Association (FIFA). FIFA’s biggest event, the Football World Cup, will kick off later this month in Qatar.

Obtaining tax exemptions is such a sensitive topic for sports organizations that there have even been instances where the events have entirely moved to another country because a country was unable to grant the exemption. For example, the T20 Cricket World Cup was moved from India to the United Arab Emirates (UAE) and Oman last year because the Indian Government did not offer the exemptions in time.

In Qatar, even though Qatar has Free Zones, only the Qatar Financial Centre (QFC) issues its own tax framework. It applies next to the general tax framework applicable in the rest of the State of Qatar. We will be looking at these frameworks in this article.

Claiming Tax Exemptions (Substantive Aspects)

For mainland Qatar, Ministerial Decision No. 9 of 2022 (Ministerial Decision) issued earlier this year on 25 August 2022 = provides details on the exemptions available to different parties, based on Government Guarantee No. (3) dated 22 February 2010 (Government Guarantee) issued by the State of Qatar to FIFA.

The most comprehensive exemption benefits are provided to FIFA itself and its affiliates (whether residents or non-residents). They are totally exempt from any taxes.

Contractors are granted a limited exemption to the extent of all taxes on import, export or transfer of goods, services and rights related to the activities of the World Cup, if the goods are imported for their use by:

- The Contractors themselves in Qatar,

- The Contractors, with the possibility of re-exporting the goods,

- The Contractors, with the possibility to donate to sports entities, charitable foundations etc.

Individuals employed or appointed by the following, are also exempt from individual taxes on payments, fringe benefits or amounts paid or received in relation to the World Cup, until 31 December 2023:

- FIFA,

- FIFA’s affiliates,

- Continental or National Football Associations,

- Event broadcasters,

- Suppliers of goods,

- Works contractors and

- Service providers.

This exemption also covers Personal Income Taxes for those individuals who enter and exit Qatar between 60 days before the first match (21 September 2022) until 60 days after the final match (16 February 2023), as long as they do not permanently reside in Qatar. This exemption may be void of much effect, given the absence of Personal Income Tax in Qatar.

An Exemption from Excise tax is to be obtained by way of refund, by providing documents like purchase invoices and bank details.

Claiming The Exemptions - Logistical Aspects

For exemptions granted by the General Tax Authority (GTA), there is no requirement to register with the GTA. Instead, FIFA (through the Supreme Committee for Delivery and Legacy (Supreme Committee)) prepared a list of exempted entities and individual, containing data such as the nature of contracted works, term and value of the contract, and the residency of the contracting party.

The Supreme Committee then provides the GTA the relevant documentation (Articles of Associations of companies, addresses of individuals etc.) in regard to the organisation or individuals for whom the Tax Exemption is applied.

For claiming customs duty exemptions with the General Authority of Customs (GAC), (and unlike the procedure with the GTA), the claimants need to register with the GAC.

Here too, FIFA approves the list for the Supreme Committee to provide to the GAC to entitle those entities to exemptions from customs duties and fees. Based on this list, the GAC provides the listed entities amongst others with facilities in regard to electronic customs clearance.

In this regard, the GAC also earlier this year launched a ‘Sports Events Management System’ to facilitate customs procedures during sporting events, including the World Cup. This system provides electronic services for the clearance of goods, including easy registrations, accelerated customs procedures, and the inclusion of a special unit to facilitate approvals for incoming shipments.

There may be some interesting questions on the applicability of the Ministerial Decision, including:

- To what extent are the activities ‘directly or indirectly’ related to the activities of the World Cup? For example, does it include online betting platforms involved in placing bets on the matches? Would it include businesses that are involved in ancillary aspects to the World Cup such as general tourism consequent to the World Cup?

- Would match fee or advertisement / sponsorship / award income earned by the footballers in relation to the World Cup also be covered under the Ministerial Decision?

- Where an event broadcaster obtains substantial advertisement income from brand sponsors during the broadcast of the match or match related activities, is such income also exempt from taxes?

QFC - Tax Exemption Regime for the World Cup

The QFC in its Concessionary Statement of Practice (Statement) explicitly provides that a QFC entity which is a:

- FIFA subsidiary – is exempt from Corporation tax and any other charge, levy, penalty or interest related thereto;

- FIFA Host Broadcaster or a Local Organizing Committee (LoC) Entity – is exempt from Tax ‘in relation to taxable profits that are derived from activities carried on for the purposes of the World Cup’.

The major conditions for such QFC entities to claim the exemption are as follows:

- Such QFC entities have genuine economic substance in Qatar,

- The QFC entity operates in terms of the license and upon authorization of the Qatar Financial Centre Regulatory Authority (QFCRA),

- An Advanced Ruling has been applied for by the QFC entity and granted by the QFC, confirming the exempt status of such QFC entity,

- The QFC entity is included in the list provided by FIFA to the QFC Tax Department,

- The sole or main purpose of such QFC entity is not avoidance of tax,

- The QFC Tax Department is satisfied that granting the exemption is not in breach of international tax principles set out in the BEPS Project minimum standards.

The potential activities that can be developed in the QFC are limited, and therefore not all types of businesses can set up in the QFC.

No VAT – No VAT Exemption

Even though Qatar is a part of the GCC VAT Agreement and committed to implement VAT in the same vein as its neighboring countries of the UAE, Kingdom of Saudi Arabia (KSA), Bahrain and Oman have done, it has not yet enacted any legislation.

Therefore, there is currently no need for a VAT exemption for the World Cup. Who knows, VAT may be introduced shortly after the organization of the World Cup?

Exemptions Worth the Trouble?

Granting tax exemptions for international sporting events are sometimes controversial. The public in some hosting countries do not always believe they receive a return on investments from the event. While Qatar has spent substantial amounts of money on the construction of infrastructure, the effect of the tax exemptions is rather limited, and at least for Qatar, it seems to have been worth the investment. In any case, the exemptions are a precondition, without which a country cannot bid. After the UAE had hosted the FIFA Club World Cup a number of times, Saudi Arabia will now be looking at hosting the Asian Winter Games in 2029. Those countries have given similar tax concessions to the international organizations managing the events.

For future possible events in the UAE, it will also be interesting to see how the sporting organizations and the tax authorities will deal with the Corporate Income Tax (CIT) which is to be introduced in the UAE in June 2023. The relationship may be anything between an unbridled and full-fledged exemption (if the UAE is willing to do so), or it may lead to rather interesting tax claims (like the Formula 1 case on Permanent Establishment (PE) in India a few years ago, which was decided by the courts in the tax authority’s favor). Time alone can tell.

Almost 5 years down the line for VAT in the GCC – what’s next?

Almost 5 years down the line for VAT in the GCC – what’s next?

Almost 5 years down the line for VAT in the GCC – what’s next?

As we approach 31 December 2022, the UAE and KSA will be celebrating 5 years of applying VAT. A rollercoaster ride for many in the region, authorities, advisers and in house tax managers.

We wrote in 2017 about the challenges of drafting VAT legislation in the GCC before its implementation (https://aurifer.tax/news/the-challenges-of-drafting-tax-legislation-and-implementing-a-vat-in-the-gcc/?lid=482&p=21).

We pondered whether the GCC was potentially going to be far ahead of other jurisdictions because of the Electronic Services System (“ESS”) the GCC VAT Agreement was going to implement, foreseen in article 71 of the Agreement (https://aurifer.tax/news/future-of-vat-in-the-eu/?lid=482&p=22). The GCC however never implemented the ESS. It is therefore missing an important instrument to integrate all GCC members under a single comprehensive regional VAT framework.

After almost 5 years, it’s worth taking a step back and looking at what occurred.

6 countries to implement, only 4 did

The GCC consists of six countries, Saudi Arabia, the UAE, Bahrain, Oman, Kuwait and Qatar. All countries were supposed to introduce VAT in a short span of time. The UAE and KSA did so on 1 January 2018, Bahrain on 1 January 2019, and Oman on 16 April 2021. For Qatar, rumours ebb and flow on an implementation of VAT after the World Cup, but officials are tight lipped. In terms of Kuwait, a new government is not likely to put this on the table – at least, in the near future.

The intention to implement almost simultaneously was taken with the idea of avoiding arbitrage – considering the geographical proximity between the states - and potential issues with fraud.

5% was supposed to be the rate

All 4 countries kicked off with 5% VAT, as it is foreseen in the GCC VAT Agreement as well (article 25). Saudi Arabia was the first one to hike the rate to 15% on 1 July 2020. Bahrain increased to 10% on 1 January 2022.

The increases were implemented for the same reason, as the tax was implemented for in the first place, i.e. fiscal stability. The implementation came off the back of a protracted period of running deficits for many Gulf countries. There is currently a bounce back, but how long it will take is unclear, and therefore hard to predict whether it will impact fiscal policy in the short run.

Saudi Arabia, by way of its Finance Minister, had already stated in 2021 that it would consider revising the VAT rate downwards after the pandemic. If it will happen, it will happen soon.

It’s safe to say the other GCC countries could still revise the rate upwards or downwards, depending on their specific fiscal situation.

Interestingly, the increase of the VAT rate to 15% also spawned a new tax in KSA, the Real Estate Transfer Tax (“RETT”). This new tax in KSA aimed to solve the issue of unregistered sellers, and reduce the taxes on real estate sales. Since its introduction, the RETT legislation has been amended multiple times.

The GCC countries were supposed to have numerical VAT numbers, Oman didn’t follow

In the framework of the GCC, the idea was floated to have numbers as VAT numbers. Hence, the UAE has a 1 before the number, Bahrain a 2 and Saudi a 3. Oman however choose letters and put “OM” before the number.

In the EU, VAT numbers are also composed of letters and numbers. Two letters make up the first two symbols of the VAT number and refer to a country, e.g. “LU” refers to Luxembourg (see https://taxation-customs.ec.europa.eu/vat-identification-numbers_en).

Zero rates for services are perceived a complication

5 years in, the application to zero-rate VAT on exported services, i.e., services provided to recipients outside of the GCC, remains complicated for businesses to apply and inconsistent between the GCC member states.

Although the GCC VAT Agreement for place of supply purposes looks like the EU VAT directive, from the outset, each GCC member state chose different approaches towards the place of supply of services.

B2B services were not simply located in the country of the recipient, as they are in the EU since 2010, and as is recommended by the OECD in its VAT/GST Guidelines on B2B services.

Based on an interpretation of article 34(1)(c) of the GCC VAT Agreement as laying down the rule, and including a benefit test, GCC countries have embarked on a conservative and selective interpretation of the zero rate on supplies made from a GCC country to abroad.

That conservative interpretation is not necessarily mirrored when those services are received, as there is no benefit test required there.

The rule is therefore applied unequal, and as shown by both the UAE and KSA, they felt the rule required amendments to the provision itself (https://www.linkedin.com/pulse/uae-considerably-restricts-application-vat-zero-rate-services-vanhee/). Those amendments, and ensuing clarifications have not necessarily led to more clarity.

Unfortunately, Bahrain and Oman went down the same road. A too conservative view of zero rates, can put a strain on foreign investments, as it is not easy to obtain refunds for foreign businesses (as amongst others the Saudi example shows).

As a matter of fact, disputes are common among businesses in the GCC over the VAT treatment of cross-border services due to the difference in the domestic legislation between the GCC member states and in the absence of the ESS.

Divergent policy options

The GCC VAT Framework Agreement allowed for broad policy options in the education sector, health sector, real estate sector and local transport sector. In addition, for the oil & gas sector zero rates were allowed to be implemented as well, and the financial sector could benefit from a deviating regime as well. Depending on the individual requirements and policies, the GCC Member States have implemented substantially different regimes.

None of the GCC countries so far have amended those policies in the aforementioned sectors. The UAE did move from a system where the B2B sales of diamonds was taxed, to a system where it is subject to a reverse charge as from 1 June 2018.

Tax Authority approaches

So far, in the region ZATCA has shown the most grit in terms of audits, and has lengths ahead of the other countries in terms of tax audits and disputes. KSA also had the best equipped tax authority in 2018 when VAT was introduced, although it did have to go through an organizational revamp. The UAE comes second, which is remarkable for a tax authority which only kicked off in 2017. It has been very much a rules and process based organization, which has a lot of positive effects, such as tax payers feeling treated in the same way. UAE auditors now often also give the opportunity to tax payers to voluntarily disclose their liabilities before closing the audit, which is a novely approach in the region.

The Bahraini and Omani tax authority, have been taking a more relaxed approach towards audits and disputes.

Having said the above, it's all not all 'sticks' with the tax authorities. We have also observed in this 5 years, how the tax authorities, especially in KSA and the UAE, played a their role to alleviate tax from being a burden to businesses and encouraging tax compliance - a fairly new culture of this scale. The amnesty programmes, first introduced by the KSA in 2020 and again, recently paved the way on encouraging tax compliance for businesses. The UAE also introduced their amnesty programme this year with the same intention. Perhaps, this could be a temporary solution to gear the economy back on track post pandemic. On whether it will be the norm, is yet to be seen in the next coming years.

What the future will bring

An old-fashioned system was put in place, yet one that has proven its use in revenue collection. It also worked, given the substantial revenues gained from VAT.

The GCC did not opted to immediately adopt more modern, electronic systems as these exist elsewhere (e.g. since a long time in Brazil, but also China).

However, it was identified that E-invoicing was the way to go in the medium run. This is again trodding down a proven path. As often in the GCC, the UAE and KSA show the way. KSA has made E-invoicing mandatory. The UAE and Bahrain have already suggested they will do the same very soon.

No GCC countries have yet announced they will adopt real-time reporting. KSA may be the closest to a potential adoption, given that once phase 2 enters into force in 2023, ZATCA, the KSA tax authority will have access to substantial transactional data. It will allow it to pre-fill the VAT return, and potentially even in real time calculate the VAT.

We'll see what the future will bring, and for sure in another five years matters will have evolved again drastically, given the pace of changes in the region.

Safe to say that the next 5 years will be equally exciting.

How anti-avoidance provisions can curtail the application of Double Tax Treaties, including in the UAE?

The Ministry of Finance (MoF) of the United Arab Emirates (UAE) recently announced that the draft Corporate Tax (CT) law is going to be released soon, and likely within the month of September. This is impactful news for businesses in the UAE. Many businesses are already in the process of taking steps to plan their affairs in such a way that their operations are tax compliant and tax optimized at the same time.

The UAE’s international position will change after the implementation of corporate tax. Some jurisdictions may no longer view the UAE as a tax haven (although the Free Zone businesses may still benefit from a 0% rate). Other tax authorities may therefore change their perspective on the UAE and be more inclined to grant the benefits under the double tax treaties.

Businesses on the other hand, will no longer view the UAE as a conduit jurisdiction with an extensive treaty network, through which they can avail tax treaty benefits. While the 9% headline rate is still comparatively low, the implementation of CT may also discourage taxpayers seeking out the UAE solely for tax purposes.

A recurring point of dispute between the tax authority and businesses in almost every country having a CT regime has been drawing the line between tax planning, tax avoidance and tax evasion. Once the UAE CT regime settles, the Federal Tax Authority (FTA) of the UAE may indeed pay more attention towards countering tax avoidance and tax evasion arrangements or transactions.

In this article, we will revisit the evergreen discussion of tax planning, tax avoidance and tax evasion, with an emphasis on the Gulf Cooperation Council (GCC). To begin, let us examine the meaning of the terms tax avoidance and tax evasion and the differences between the two terms.

Tax avoidance has traditionally been considered as lawful. It can be described as planning for the purposes of minimizing the tax burden within the legal framework. Tax evasion on the other hand is considered unlawful, and often requires an intentional and a potential fraudulent element.

In the GCC, tax authorities resort rather quickly to suggesting a taxpayer has committed tax evasion, even when the situation concerns simple non-compliance.

While not considered unlawful, tax avoidance has been considered harmful. This is why countries around the world, including the GCC Member States, are implementing domestic rules to counter aggressive or harmful tax planning in line with international standards.

The OECD tried to address this point by way of the ‘Main Purpose Test’ (MPT). The MPT was included in the OECD’s Model Tax Convention in its 2003 version. We are paraphrasing, but the principle stated that benefits under a double tax treaty should not be granted where the main purpose of setting up a structure was for tax purposes as the tax benefits resulting from that structure would go counter the object and purpose of those treaties.

Another common mechanism proposed in tax treaties to avoid the improper use of tax treaties, is the ‘Beneficial Ownership’ (BO) requirement. It mainly applies to passive income (e.g., dividends, interests, and royalties). The BO concept provides that where an item of income is paid to a resident of a Contracting State acting in the capacity of an agent or a nominee, it would be inconsistent with the object and purpose of the source state to grant an exemption or relief, merely because the direct recipient is a resident of the other Contracting State. In such a case, the direct recipient, on account of being merely an agent, nominee, conduit, fiduciary, or administrator, would not be able to obtain the benefits of the treaty. This is especially evident if such recipient is legally or contractually bound to pass on the payment received to another person. BO disputes often end up before the courts, because the burden of proof for the taxpayer is not easily met.

The 2008 Financial Crisis put the discussion on tax avoidance and aggressive tax planning firmly on governments’ agenda. Following the Financial Crisis, public opinion shifted towards ensuring that big corporations pay their fair share of taxes and pressured countries to implement rules to discourage such behaviors.

As a result, the OECD established what is known as the ‘Inclusive Framework’ (IF), which was open to both OECD and non-OECD members (currently at 141 members) to engage in discussions and create rules for countering Base Erosion and Profit Shifting (BEPS). It is formally known as the OECD/G20 BEPS Project (BEPS Project 1.0) which identified 15 Action Points in 2015.

Out of the 15 Action Points, one of the most important action plans was BEPS Action 6 - Prevention of Tax Treaty Abuse, which also formed one of the four minimum standards. BEPS Action 6 addresses treaty shopping activities that would be viewed as avoidance.

BEPS Action 6 requires IF members, amongst others, to include an express statement in their treaties that their common intention is to eliminate double taxation without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance, including through treaty shopping arrangements.

Anti-avoidance rules aim amongst others to avoid conduit arrangements. For example, State A has a domestic withholding tax rate for dividends of 25%. State A and State B have negotiated a tax treaty where the source withholding tax rate for dividends is reduced to 5%. A resident in State B receives dividends from State A and claims the reduced treaty rate of 5% source withholding.